Sales Enablement Solution Design

When you are developing your solution, the Design stage is particularly important—it lays the foundation for the project. We have found that these four steps reliably lead to a solid design:

1. Identify Stakeholders

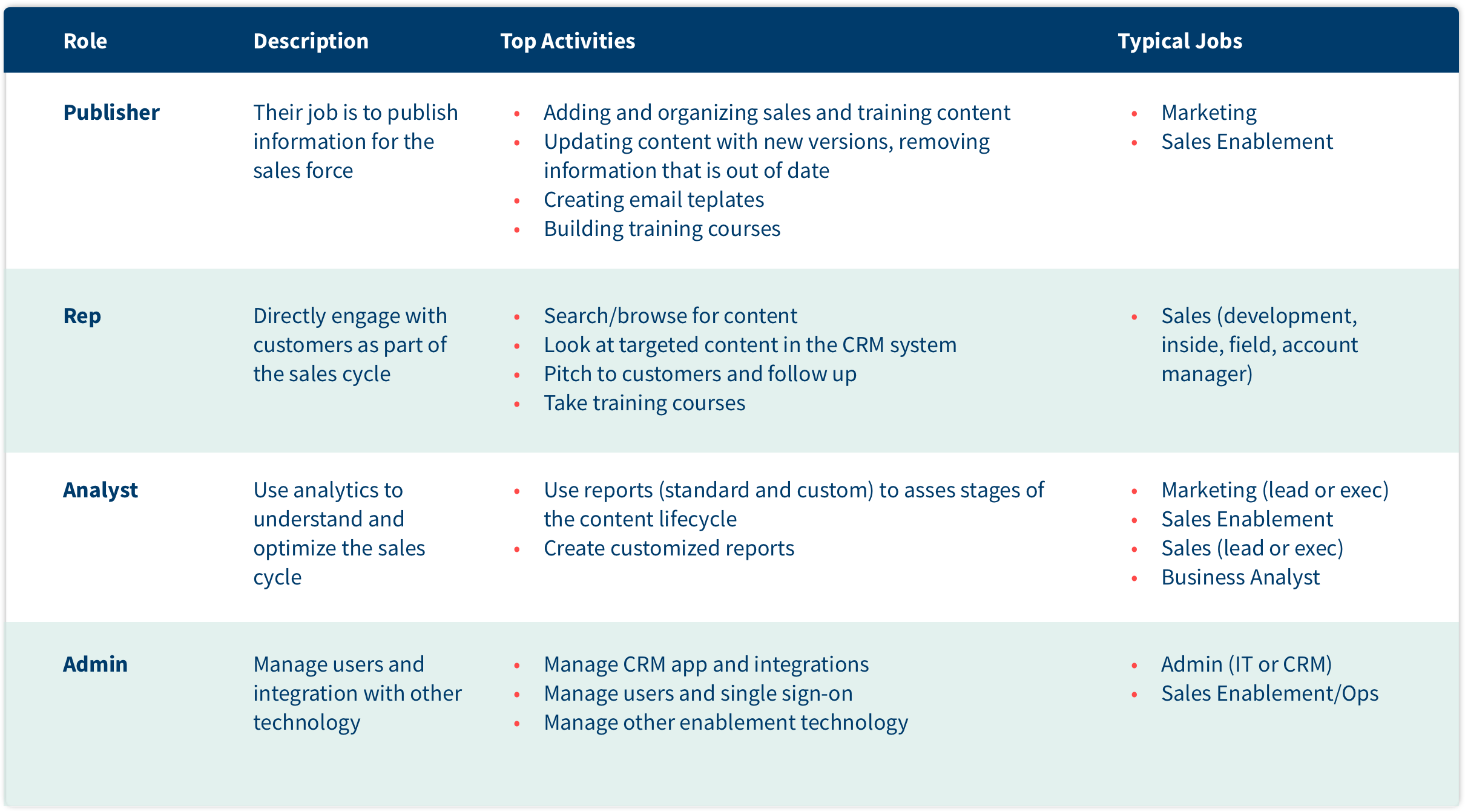

We find it helpful to think about solution users in terms of their role:

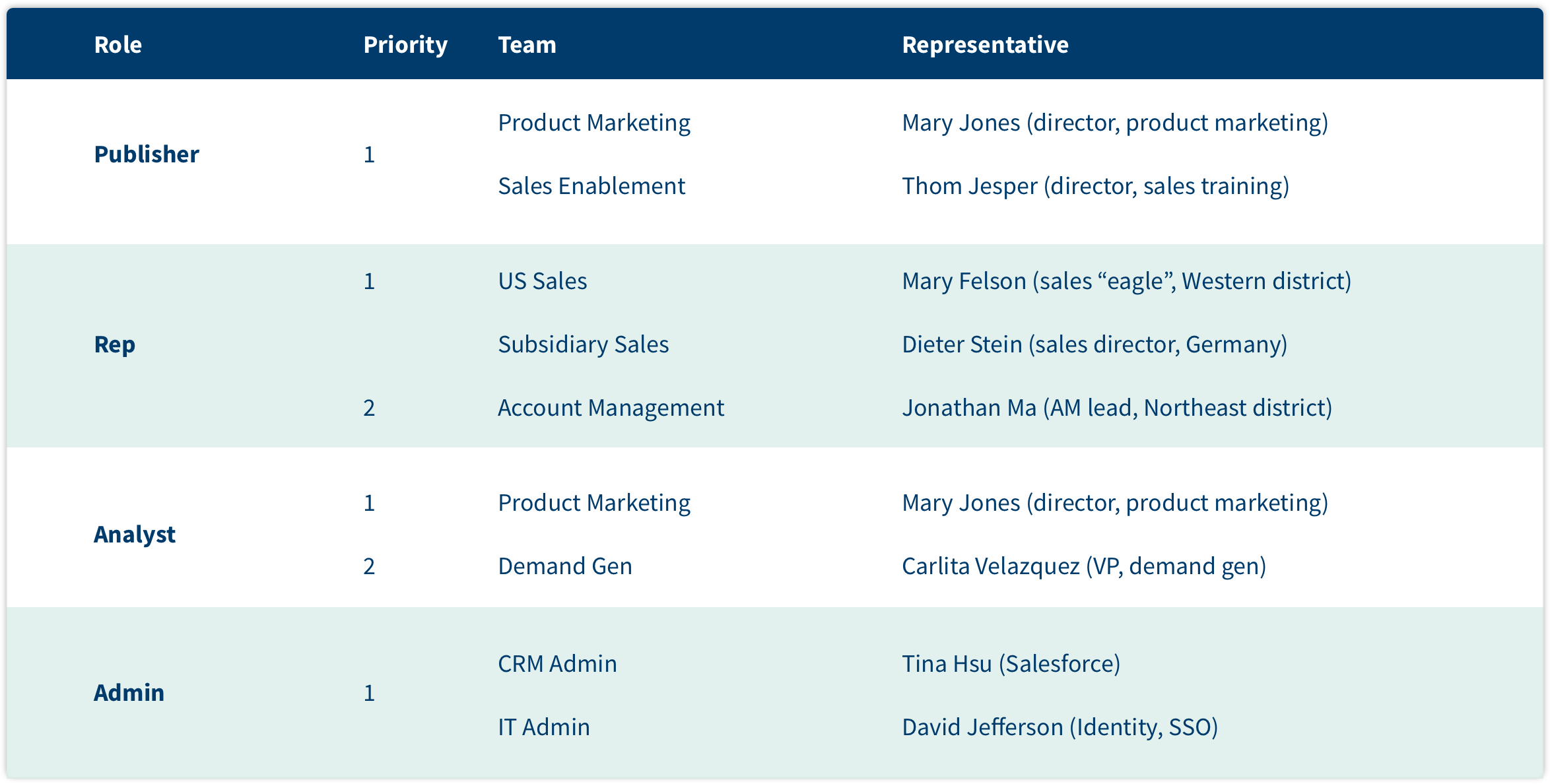

Once you have identified the key users of the system, it is helpful to put that into a team map that lists the teams involved. We prioritize the teams, based on how much of a focus their needs will be for this deployment. We also choose a representative for each team who can speak on its behalf. These representatives are involved in the development of the solution, either as a core member of the team or as a resource to be consulted during planning, design, and validation.

Here is an example of a team map for a company that has global subsidiaries:

2. Map Your Content

Next, think about the content that you want to capture.

As we mentioned in a previous section, it is important to focus initially on the content that is most important, rather than trying to capture every possible thing a seller might need. While you may use this opportunity to do some cleanup, we strongly recommend that you not try to make all the content perfect before you launch—it’s easy to get bogged down in multiple open-ended content initiatives. Anyone who has remodeled a house will be familiar with the dangerous phrase, “well, as long as we’re doing that, we might as well …” Giving the sales team a well-organized way to find the content you already have is a typically a big step forward in making them more effective! You will keep improving it forever—that is a job that is never “done”.

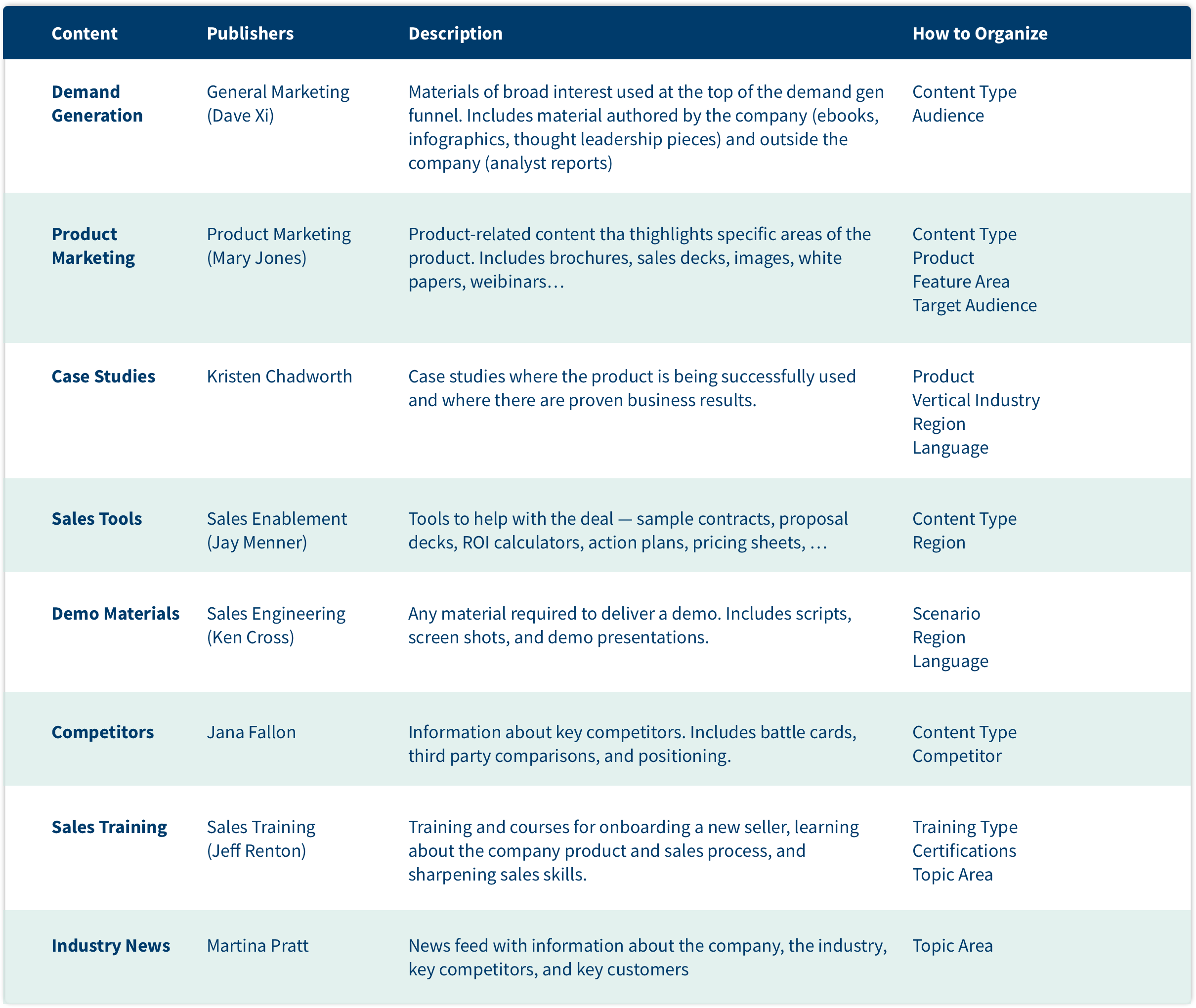

We capture the result of this exercise in a content map. Here is a typical example, where the company has decided that it will divide the sales information into eight groups. For each type of content, we show who is responsible for publishing it. The publisher might be a team (for something like product marketing), or it might be a single person. Where the owner is a team, we’ve chosen one person who is on point to represent it. Choosing a single representative is best, if possible—then you can make sure that you have somebody available who deeply understands each key type of content, but keeps the number of people involved to a manageable number.

There are many ways to divide your content into top-level groups. Here are some rules of thumb that we have found very useful in finding the best solution:

For most companies, it’s reasonable to aim for something like 8-12 top level categories that apply to the mainstream user.

That’s enough to keep things organized, but not so many that reps and publishers have to waste time figuring out where to look. A user can quickly scan the whole list to find the right place to go.

Get it right for the mainline sellers, then take care of the more specialized teams.

Often, there will also be specialized areas of content for particular roles, or particular regions, or the like. First make sure that your design works well for the typical seller, then start addressing those more specific requirements.

It is often best to put specialized content in separate areas, especially if it might be confusing to the people who aren’t interested in it. The people who need it will know what they are looking for, and the mainline sellers won’t see it mixed in with everything else.

Groups should be intuitively obvious for reps and publishers to understand.

You don’t want people to guess where something should go—try to make it as obvious and unambiguous as possible.

At the top level, don’t pick things that change often. For example, the marketing themes for the current fiscal year are not a good choice. They change every year, and often it isn’t obvious at all which of them a particular piece of content goes in. Is this pitch deck more about “Ultimate Flexibility” or “Industry-Leading Performance”? Or neither? Or both? You might choose to assign items to themes within a particular group—that can be very useful—but don’t use groupings at the top level that aren’t as drop-dead obvious as you can possibly make them.

The great majority of your content should fit obviously into a single top-level category. As we will see in the next section, this is why using the stages of your sales cycle as the organizational model is usually a bad idea.

Ideally, there is a small set of publishers for each group.

It’s easy to have different people working on different groups of content, but if you have a lot of people all managing the same group, that can cause problems. A small group of people making the key decisions about a particular set of content will almost always yield a better result.

Consider breaking out content that has important and unique ways of being organized.

For example, take case studies. There are often a large number of them, and in many companies they are organized quite carefully and in different ways than most content. In particular, they might be organized by vertical industry, by region where the customer is located, by language, by product, by scenario, and so forth.

A rep who needs a case study knows exactly what they are looking for and wants to be able to browse quickly, using whichever dimension(s) are most applicable to their customer. An enterprise in Europe might insist on seeing a case study from one of a few countries they feel are similar to their own. A manufacturing company might want a case study from their own industry. Somebody who is looking at your Cloud PBX product doesn’t care about your success in deploying some other product.

3. Target the Buyer’s Journey

Once you have the key types of content figured out, we strongly recommend that you map them to the buyer’s journey. The term “buyer’s journey” is meant to capture the set of experiences that a buyer goes through. It begins when they first learn about your company and its products. Over time, they engage with you and become a customer. Then there is an ongoing relationship where they hopefully renew their contract/subscription and/or purchase additional products. This journey is often described using a model like the sales funnel, as discussed earlier.

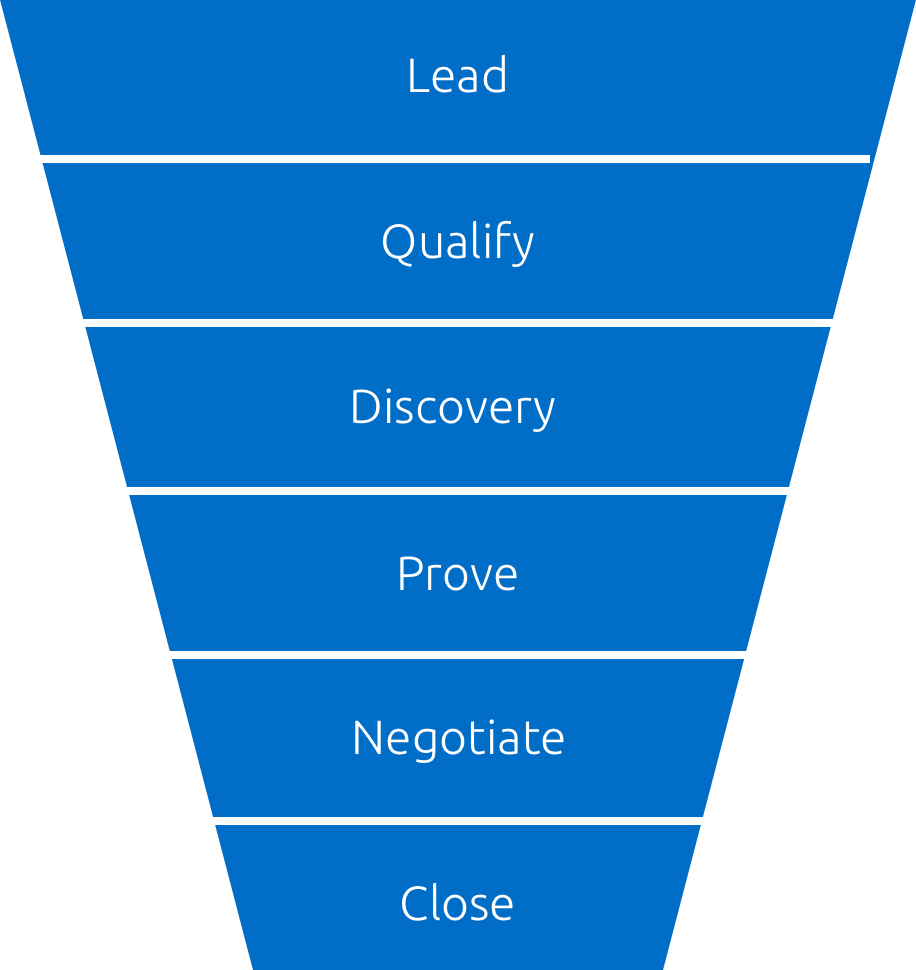

Sales enablement focuses on the second half of the sales cycle, when the sales team is involved. Many companies have developed a formal description of the buyer’s journey during this phase by defining the stages of an opportunity in their CRM system. For example, here is a typical set of stages:

Note that these sales stages are an imperfect approximation of the buyer’s journey. In most cases, it would be more accurate to describe them as the seller’s journey. The focus in the CRM tool is typically on tracking the progress of each deal and forecasting the likelihood that it will close. It often doesn’t perfectly reflect the buyer’s point of view, but it’s a good starting point. It does show the stages through which deals typically go, and in many organizations it is well defined and consistently tracked.

Use Stages for Targeting Content, Not Organizing It

We cautioned earlier that the sales stages are typically not a good way to organize content at the top level because the mapping is too ambiguous. We can see that when we consider what items might used by a rep at each stage of a deal. For example, consider the set of case studies that the company has created. For the buyer, case studies serve a variety of different purposes—they provide credibility that you solve real problems for real companies, they showcase use cases that your product addresses, and they highlight the business value that buyers will receive.

Buyers may ask for case studies throughout the sales cycle. They might want to see one quite early in the conversation, to see whether you are a credible vendor they should bother with—it might even come up during the Lead or Qualify stages. During Discovery, where your goal is to figure out if your product is a good solution for their problems, they might want to see a case study to get ideas about what you can do for them. The Prove stage is the one where customers are “officially” supposed to want to see case studies. But it’s possible that they want one during Negotiate, to convince some higher up to spend the money on your product. And after you Close a deal, you might use one (if you won) to convince the customer to expand their use of your product and get more value, or (if you lost) to try to get things restarted.

So if you were trying to organize content by stage, you could make an argument that you should put case studies in every stage. That’s a bit of an extreme, but it is very common for content to be useful during multiple stages, making sales stage a poor way to divide up the content at the top level. Publishers would always be guessing which stage to put things into, and reps wouldn’t know where to look.

However, it is extremely useful to target content by sales stage. The goal is to recommend the content that is most likely to be useful for a particular deal. You will never be able to predict everything that might be useful, and shouldn’t try. That’s why the system needs to have great support for searching and browsing—customers ask about all sorts of different topics, and they don’t organize their requests neatly into an “appropriate” sales stage. But there is generally a small set of content that is very likely to be relevant to any particular deal, and the goal of targeting is to put those items at the seller’s fingertips.

The sales stage is often the best indicator as to which content the rep is most likely to need. If they are in the Prove stage, customer evidence from similar deals is going to be very likely to come up. But sales stage alone is not the only consideration. It might depend on which industry the customer is in—you might have a pitch deck that is customized for the industries you most commonly target. Or it might vary by region—the deck that the team in Spain uses to pitch your product is probably not the same one that is used in the US. The right content can also vary by role of the user. An account manager who is supporting and growing the account of an existing customer probably uses different content than the account executive pitching a new customer who has never heard of your company before.

Depending on your business, targeting might be based on a wide range of characteristics of the deal, the customer, or the seller. So how do you decide what to show the rep?

The “Rule of 7”

When companies first think about targeting content, they sometimes start out with very ambitious goals. They envision themselves as a star quarterback dropping the ball right into the outstretched hands of the receiver on the way to a touchdown, delivering exactly the right content with pinpoint accuracy. This may be possible if you have an extremely structured sales process that is highly repeatable and controlled, but in most cases it is better to start with the basics and refine it over time.

We like to use an exercise we call the “rule of 7”. To get started, choose a particular seller and a particular deal. For example, you might pick an account executive in the Western US region who is pitching a telecom company on your Cloud PBX product. The deal is currently in the Discovery stage. You are only allowed to know as much about the deal as will reliably be captured in your CRM system, since that is what the sales enablement solution is going to know. Now the exercise is to come up with the set of content that the seller should have right in front of them for this deal, and force yourself to have no more than seven items. An item can either be a specific document, or it can be a link to a collection of items that are filtered down to the ones most likely to be relevant.

For this example, we’ll be even more disciplined and restrict ourselves to just six:

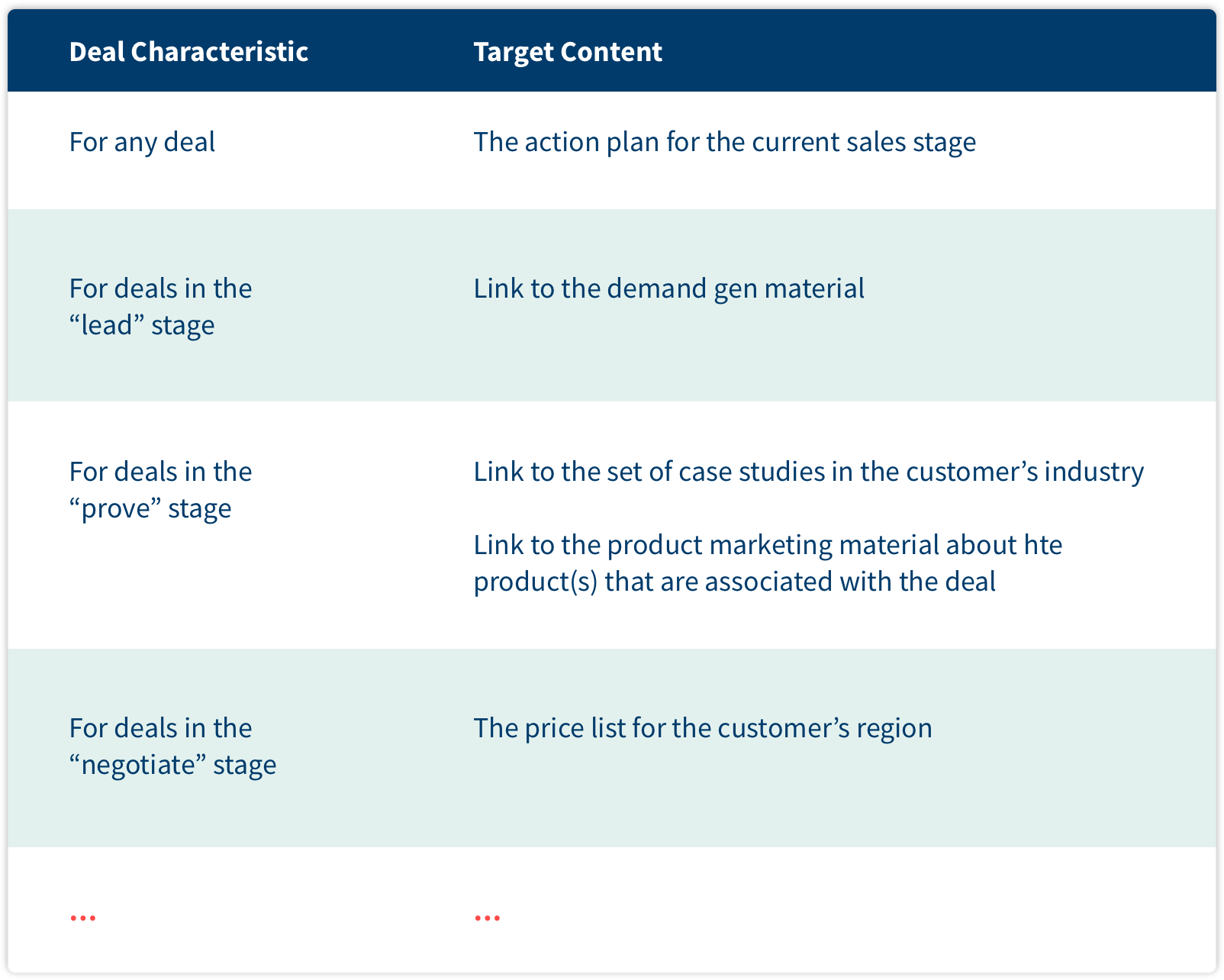

Once you have done a few examples like this, you are ready to create your general targeting plan. It describes the content that will be targeted for any deal in the pipeline, based on various characteristics. Here is an example showing part of a targeting plan:

As discussed earlier, we recommend that you start with the basics. You can always refine and extend your targeting once you have it up and running, and you can use analytics to see which of your recommended items actually get used successfully by the field in practice.

Targeted content is much more likely to get used if it appears in your CRM system as part of the opportunity. The rep will always have instant access to the content they are most likely to need, customized for the deal they are working on. The platform can also use data science to score every piece of targeted content and suggest additional items, based on what has been working for the sales team in similar deals.

4. Catalog Existing Resources

The last step is to make sure you understand the systems that your company already has in place and that are relevant to your sales enablement solution.

Here are some common examples:

Content storage

Companies often have a wide range of systems where content is currently stored. They might be using cloud file systems like Dropbox, Box, and the like. They may have custom web sites, or SharePoint sites. Content may also be stored in the CRM system (such as the Content tab in Salesforce) or it may be linked inside of various social networks, like Chatter or Yammer.

You might integrate these systems with your solution—cloud file systems and social networks are natural partners for your publishing platform. Some of the content stores may be retired after you deploy.

Identity

The company may use Active Directory internally and/or a federated identity provider like Okta to give their employees access to internal or external systems. Single sign-on is a convenient way to reduce the cost of managing the solution.

CRM systems

Most companies use a CRM system (like Salesforce.com) to track their sales opportunities. Your sales enablement system can integrate closely with it to enhance rep effectiveness and measure the business impact of content and readiness investments.

HR and Learning Management systems

Training and performance may be managed through specialized systems (like SuccessFactors and WorkDay). You may choose to integrate them with other parts of your solution.

Web conferencing

Systems like WebEx, GotoMeeting, or join.me allow sellers to present material to customers remotely over the Internet. Your sales enablement solution may also have this technology built-in. Web conferencing allows your reps to reach out to customers for presentations and demos, wherever they are.