Sales Enablement Solution Health

A modern business is deeply data-driven. Once you have your sales enablement solution in place, you are ready to analyze and optimize your sales process.

With respect to sales enablement, there are three main areas to apply data-driven methods:

In this chapter we focus on solution health.

Solution Health Overview

The solution that you have implemented is not going to do much good for the company if it isn’t being used. We have found that it is most useful to measure that in three ways:

Adoption

How many people have ever used the solution. If the solution requires users to sign up for an account, the number of accounts that have been created is a simple way to measure adoption. If you are using single-sign on, where accounts are automatically created as needed, you can use the number of people who have visited the enablement platform at least once.

Breadth Usage

This is another fairly simple metric, showing how many people used the solution over a period of time. Our primary view is the previous 30 days, which is usually a good way to understand normal usage. Patterns of use will often vary quite a bit over a single day or week, and those numbers can be affected heavily by a short-term event like a holiday or the end of a financial quarter. But if the solution is a core part of their work, looking at a 30 day period gives a reasonable picture.

To broaden the view farther, we sometimes compare activity during the past 30 days to the current content cycle. At many companies, there is a cadence for updating content that is tied to some event such as a sales kick-off. It might happen once or twice per fiscal year, or coincide with an external conference for partners and customers. At such moments, there is often a major refresh of content. Looking at usage since the last such refresh shows activity for users who don’t visit as regularly but do come for new and updated information when it is released.

Depth Usage

This metric can take more thought to compute than the other two, which don’t vary too much from one company to another. The goal is to measure how many people have used the product to accomplish something of value. We use a standard set of depth metrics that work reasonably well across many different organizations, but you may find it worthwhile to develop your own custom depth metrics to measure the activity that you are most interested in encouraging on the platform.

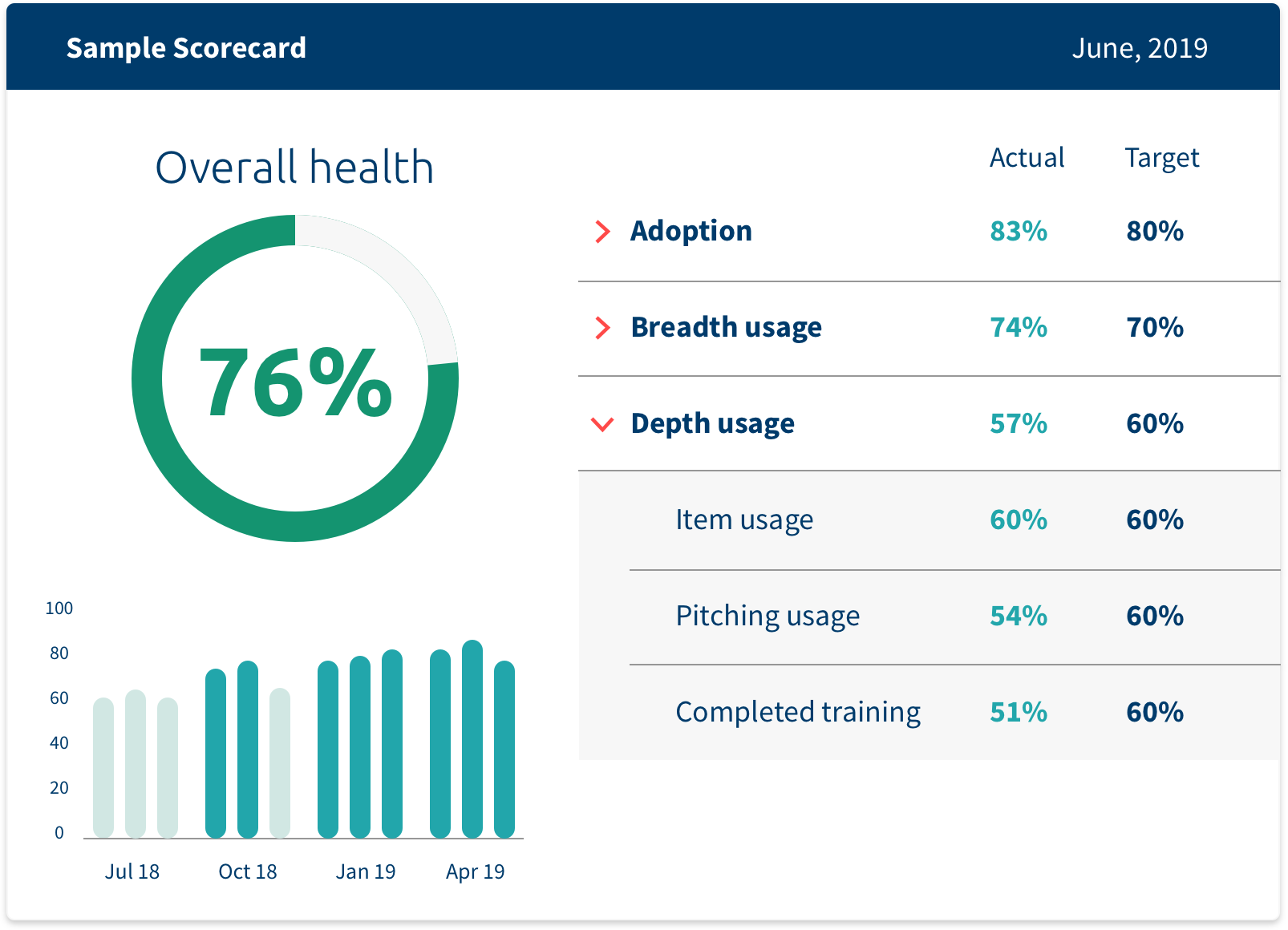

Scorecard

To track these metrics, we rely on a scorecard. It shows the current state of each of the three key metrics, assigning each of them a green/yellow/red color based on the target value. We also show a historical view to help put the current health in context.

Note that the scorecard shows each of the three metrics (adoption, breadth, and depth) and combines them into a single overall health value that is computed using a weighted sum. We use different weights depending on the maturity of the solution.

In the post-launch stage, when the solution is new to the organization, the focus is generally on adoption and breadth usage. The goal is to get everyone aware that the solution is available, signed up and enabled for use, and for them to start experimenting with it. The sample scorecard shows a solution that has been recently launched and it emphasizes those first two metrics.

In steady state, adoption and broad usage remain important, but the focus shifts to put more emphasis on depth usage. It’s not enough that people find and use the solution; the key is whether they are getting value.

How to measure that will depend on your environment, but some metrics we find useful are how many people took an action like viewing an item or downloading it, how many people pitched, and how many reps have completed a training course. In addition, it may be useful to measure the number of actions generating value—how many items were viewed and downloaded, how many pitches were made, and so forth. Best practice for depth is often to have a number of different metrics and combine them together in a weighted average.

Depth usage is important not only because it delivers the most value to individual users, but it also typically yields the best data for measuring the effectiveness of your content. For example, if the sellers are not using the platform to pitch content but are instead simply downloading it and sending it via email, you will miss a lot of customer engagement data that you could have used to do a better job of optimizing your content.

In steady state, a healthy solution has been almost universally adopted, has strong regular breadth usage, and has a significant percentage of the sales team using it in depth to enhance their sales efforts.

Other Metrics

In addition to usage, there are other ways to gather useful metrics about the solution, such as sending out polls. We encourage using a variety of ways to gauge the effectiveness of the solution. However, we do recommend that you make usage your primary measure of health. There are pitfalls to be careful about—if a user wastes a lot of time hunting for something and never finds it, the metrics can show a lot of usage and that user is definitely not happy with their experience. But over time, users vote with their feet. If they don’t get value, they will gradually reduce their usage to the bare minimum. If people come to the solution frequently, spend a lot of time on it, and there is strong depth usage reflecting successful use, that’s a reliable indicator that you are providing value to them.

Look at Usage by Team

Companies often find that a solution has been broadly adopted across the organization, but some teams have been left out. So in addition to looking at the health across the entire target population, you should also spot-check other teams. For example, if your company is international, look at usage health for the subsidiaries. If you segment the sales team by vertical, or by size of the target customer, look at usage in the different segments to spot any issues that you need to address.

Qualitative Health Tracking

The metrics described above will give you a good picture of how the solution is being adopted and used across the organization. However, it won’t tell you why there are problems and how the system could be further improved. In addition to metrics-based scorecards, it is important to reach out and talk to representative members of the user community.

We recommend a series of brief outreach interviews with:

Power users from each key community

For example, your most prolific publishers, content consumers, and pitchers. The sales enablement platform should give you reports that make it easy to identify who these people are. These users tend to have the most experience with the system and give the most detailed and demanding feedback.

Regular users

These people will give you a sense of what the typical user’s experience is like. They may have different needs and expectations than the power users, so you don’t want to confine your discussions to the committed experts. Most people won’t become expert users—they will do what they need to in order to get their jobs done.

Non-users who should be using the system

If some of your target user community rarely or never logs on, find out why. They might not know about it, because they were missed in the rollout. Maybe they don’t know how to use it, because there wasn’t the right kind of training. There might be some other solution still in place that they are using instead. Or perhaps their team has particular needs that are being poorly served. You won’t know how to improve adoption if you don’t know what is holding it back.

These conversations can be relatively short—the key is to understand what is working well and the top things that are making life difficult for the users. A few questions you might want to ask:

- What is your role in the organization? What team are you part of?

- What are the most difficult challenges you deal with?

- How does content play a part in your job?

- What do you use the sales enablement solution for? How is it working for you? Can you find what you need, quickly?

- Did you get the right amount of training on the so that you know how to take advantage of the solution?

- What is really working well? What is not working?

- Is there content you need that isn’t available? Do you have to build content yourself that you think the company should already have available?

- Are you aware of the job training that is available to you? Is anything missing that you think we should be offering?

- Have you taken any training? Was it worth the time? How could it have been improved? What could we do to better prepare you for the challenges that you face in your role?